How To Read the Different Parts of an Insurance Policy

Are you feeling overwhelmed by the multitude of components in your insurance policy? Don’t fret, you’re not alone. Insurance policies can be intricate and perplexing, but it’s crucial to comprehend what your policy covers and what it might overlook. Knowing how to read the different parts of an insurance policy is important, so you can completely grasp your insurance policy in and out.

Declarations Page

This page acts as a comprehensive summary of your policy, providing essential information that will differentiate your insurance policy from others. Some of the most essential information you’ll find in this section include:

- Names of people and assets the policy covers

- Policy number

- Coverage amounts

- Deductibles

- Policy details

- Endorsements

- Discounts

The declarations page serves as a quick reference point, allowing you to easily access your insurance policy’s key details. You can quickly understand the scope and specifics of your coverage by having this concise and informative page at hand, ensuring peace of mind and clarity when it comes to your insurance needs.

This section is one of the most important, which is why reviewing it regularly is crucial. Be sure to carefully review your declarations page anytime there’s a significant change in your life and contact your agent or insurance company if things aren’t correct or there’s missing information. The policy’s language is exact, so you and your company need to work together to make sure everything in the policy reflects reality if what’s written isn’t accurate.

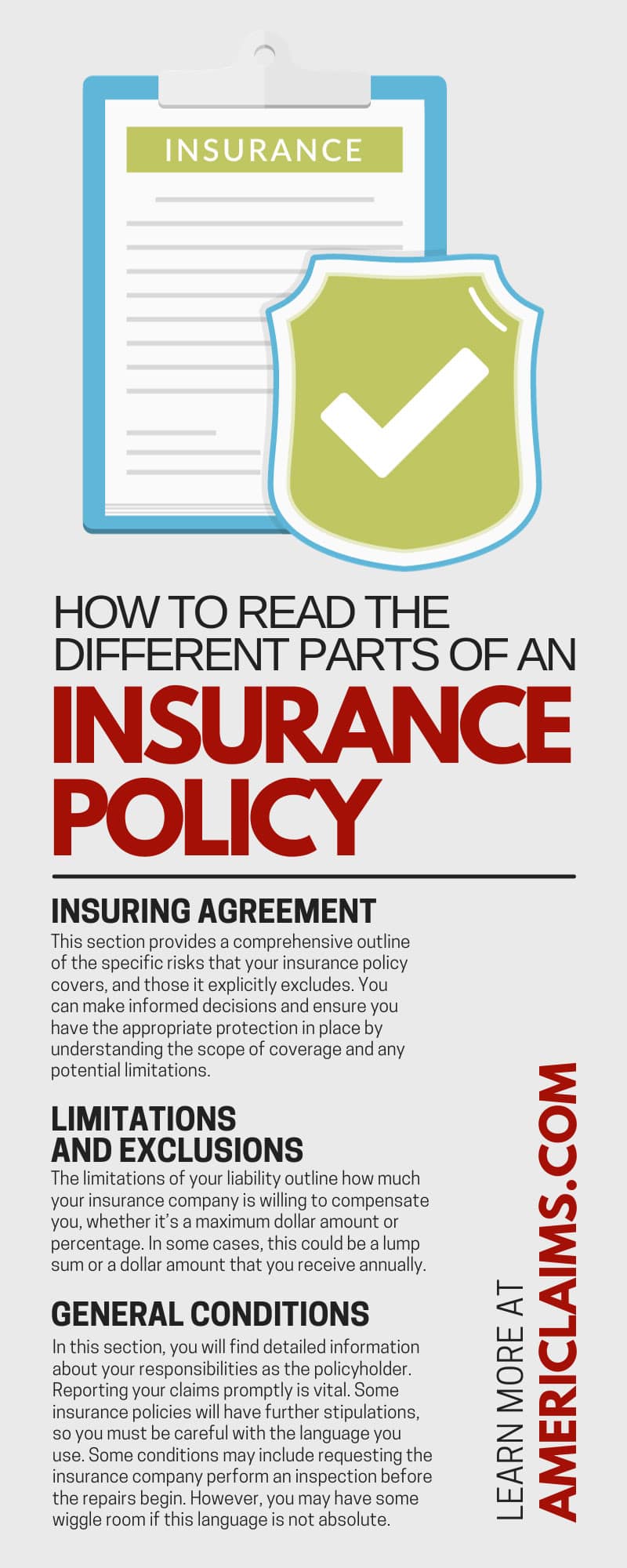

Insuring Agreement

This section provides a comprehensive outline of the specific risks that your insurance policy covers, and those it explicitly excludes. You can make informed decisions and ensure you have the appropriate protection in place by understanding the scope of coverage and any potential limitations.

This insuring agreement is the weight of the insurance policy, defining what services the insurance policy promises you under the premium you’re paying. Depending on your policy, this insuring agreement could be known as policy coverage. This section is broad, but the other parts of the policy further narrow the scope of the entire insuring agreement.

Limitations and Exclusions

Paying meticulous attention to exclusions is important when reviewing your insurance policy. These exclusions outline specific situations or events that your insurance will not cover. By understanding these exclusions, you can have a clearer picture of your coverage’s limitations and make informed decisions about additional protection or alternative solutions. Taking the time to thoroughly comprehend the exclusions can help ensure that you have the appropriate level of insurance coverage for your needs.

The limitations of your liability outline how much your insurance company is willing to compensate you, whether it’s a maximum dollar amount or percentage. In some cases, this could be a lump sum or a dollar amount that you receive annually.

General Conditions

In this section, you will find detailed information about your responsibilities as the policyholder. Reporting your claims promptly is vital. Some insurance policies will have further stipulations, so you must be careful with the language you use. Some conditions may include requesting the insurance company perform an inspection before the repairs begin. However, you may have some wiggle room if this language is not absolute.

Endorsements and Riders

Carefully evaluate any endorsements and riders that your policy may include. These additional documents serve to modify or augment the coverage your policy provides, tailoring it to your specific needs and circumstances. You can ensure your policy provides the comprehensive protection you require by taking the time to understand these additional provisions.

Definitions and Terminology

Comprehending the definitions your policy uses is crucial as they frequently contain technical terminology. You can better navigate, make informed decisions, and ensure proper coverage by understanding the meanings of these terms. Taking the time to grasp the intricacies of insurance language enables you to have a clearer understanding of your rights and obligations.

Coverage Limits

Ensure you understand the coverage limits when reviewing your insurance policy. These limits represent the maximum amount that your insurance provider will pay in the event of a covered loss. You can ensure you have adequate protection and avoid any unexpected financial burdens by familiarizing yourself with these limits. Having a clear understanding of the coverage limits is crucial to making informed decisions and effectively managing your insurance needs.

Insurance Deductibles

You must also be mindful of deductibles when reviewing your insurance policy. Deductibles represent the initial amount that you are responsible for before your insurance coverage comes into effect. Understanding the specific deductible amount and how it impacts your financial obligations can help you make informed decisions about your insurance coverage.

Special Provisions

Take note of any special provisions when reviewing your policy. These provisions are additional conditions or limitations that may apply to your specific policy. Special provisions serve as important details that could impact your coverage, so you must understand them. You can ensure you have a comprehensive understanding of your policy and make informed decisions regarding your insurance coverage by being aware of these supplementary provisions.

In Conclusion

An insurance policy should protect you, but it’s hard to know that just by looking at countless pages of complicated text that’s seemingly impossible to decipher. Thankfully, when you understand each part of your policy, and you know where to get professional help, you can guarantee the insurance you choose is right for you.

Additionally, be sure to look through your insurance policy early so you get the right coverage, and so you can make any changes if necessary. For example, you could spot coverage gaps that could leave you in a bad situation without the right resources at your disposal. Look through your policy, increase your overall understanding, and close any coverage gaps you identify. This strategy will ensure your policy works for you and not the other way around.

Approaching the task of knowing how to read the different parts of an insurance policy reading an insurance policy may seem daunting initially, but armed with these comprehensive tips, you can navigate your policy with ease. Remember, you can always consult your insurer or AmeriClaims, the public adjuster services company that has your back if any questions or concerns arise. Investing the time into meticulously reading and understanding your policy will safeguard you from any surprises in the future, providing you with peace of mind.