5 of the Most Common Causes of Water Damage

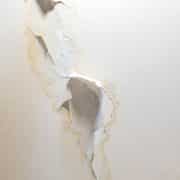

Water damage is a prevalent issue that people in many regions nationwide experience, but just because it’s common doesn’t mean it’s normal. Water damage can be disastrous, but you can prepare and protect yourself and your home when you know some of the most common causes of water damage. It’s still going to take some work, but knowledge is one of your biggest allies in the fight against water damage.