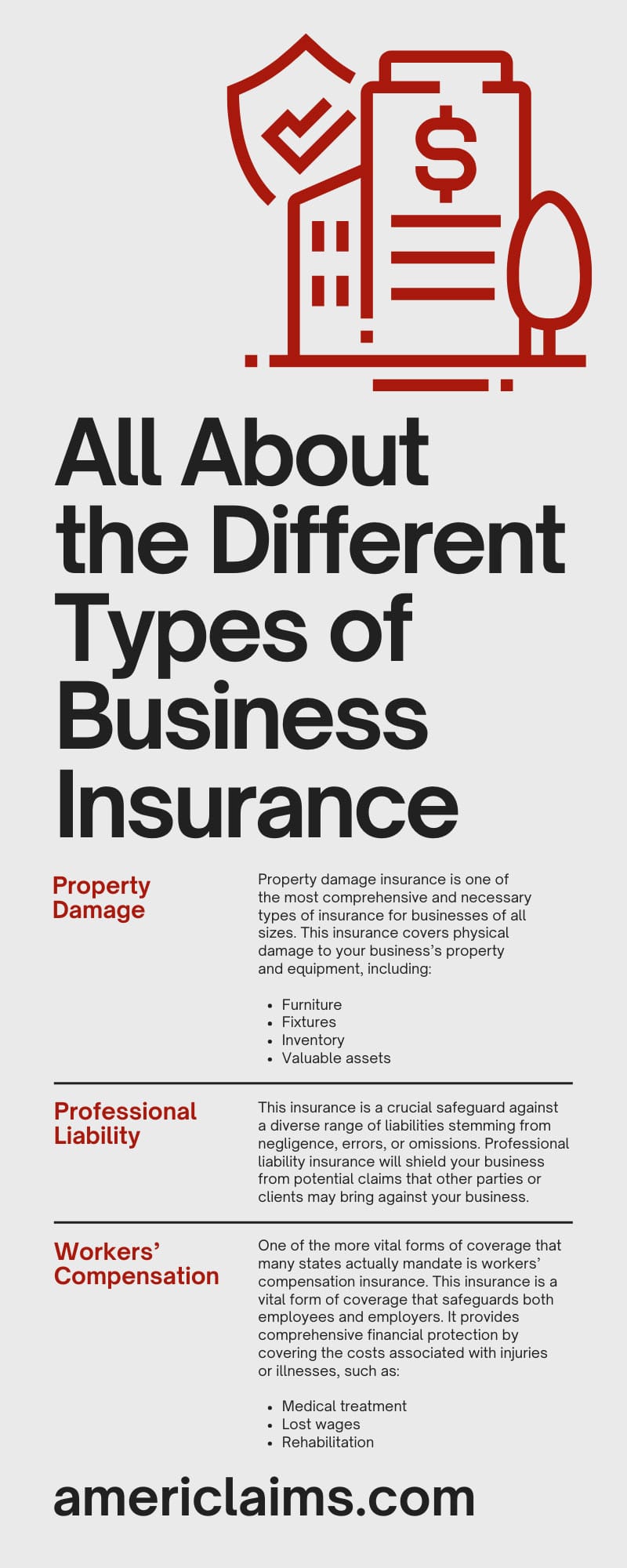

All About the Different Types of Business Insurance

Whatever industry your business is in, you can’t expect to reach success without encountering a few bumps in the road here and there. Some of these bumps are easier to deal with, while others can completely derail your business if you’re not careful. However, business insurance can help you through tough times. Learn about all the different types of business insurance so that you can get the type of insurance that will best protect your business.

Property Damage

Property damage insurance is one of the most comprehensive and necessary types of insurance for businesses of all sizes. This insurance covers physical damage to your business’s property and equipment, including:

- Furniture

- Fixtures

- Inventory

- Valuable assets

Whatever the source of the damage may be, whether it’s a natural disaster or malicious intent, property damage insurance will help cover the costs that come with repairs, replacements, and complete restorations. Property damage insurance offers peace of mind and ensures you have the necessary financial protection to rebuild your business swiftly and efficiently after it has undergone damage, big or small.

Professional Liability

Another common kind of insurance that many businesses have is professional liability insurance. This insurance is a crucial safeguard against a diverse range of liabilities stemming from negligence, errors, or omissions. Professional liability insurance will shield your business from potential claims that other parties or clients may bring against your business. For example, if you have a construction business and an architect made a mistake that set the project back and hurt your client’s finances, your client could file a lawsuit. In a situation such as this, your professional liability insurance would protect you.

Product Liability

Product liability is another type of insurance that many businesses have to protect themselves. This insurance protects businesses involved in manufacturing or supplying goods and services to consumers in the case of a product or service issue. Proper product liability insurance safeguards businesses against damages from lawsuits relating to product defects, failures, or malfunctions.

With product liability insurance, companies can confidently navigate the complex landscape of consumer protection and mitigate potential risks associated with their offerings. For example, if your company produces rechargeable batteries that accidentally catch fire and burn users, your customers have reason to sue. In instances such as this, product liability insurance would cover any costs incurred during these suits.

Workers’ Compensation

One of the more vital forms of coverage that many states actually mandate is workers’ compensation insurance. This insurance is a vital form of coverage that safeguards both employees and employers. It provides comprehensive financial protection by covering the costs associated with injuries or illnesses, such as:

- Medical treatment

- Lost wages

- Rehabilitation

If your business has more than three employees, your state likely mandates workers’ compensation insurance. This coverage protects your business and employees from the problems that come with unfortunate incidents. When you offer this crucial support, you’re creating a safe, secure working environment. Employees never intend to get into a workplace accident or fall ill, but they can rest easy knowing that if such a situation were to occur, they would emerge from the other side financially okay.

Commercial Vehicle

If your business utilizes commercial vehicles, another form of insurance you must get is commercial vehicle insurance. This type of insurance covers any vehicles your business owns and uses, including cars, trucks, vans, and trailers. Most states require commercial vehicle insurance to protect businesses, drivers, and any others who may be hurt in an accident on the road.

In the unfortunate event of an accident, this insurance will protect your business by providing the financial support you’ll need to handle any vehicle damage as well as any costs that may emerge from injuries. It’s an unfortunate reality that roads can be unsafe, but with the right insurance policies behind you, any accidents that do occur won’t derail your business’s finances.

Cyber Liability

A modern form of commercial business insurance that more and more businesses are picking up is cyber liability insurance. This insurance covers damages and losses you may incur due to data breaches or cyberattacks. You don’t ever want any of these breaches or attacks to happen, but they won’t be the end of the world with the right insurance policy.

With the increasing prevalence of cyber threats, having this type of insurance is a must for businesses that handle sensitive data, such as customers’ financial information. Your business can quickly recover after a cyber incident with cyber liability insurance. Be sure to invest in this insurance so that you can properly safeguard your customers’ data and protect your business’s financials.

Business Interruption

Business interruption insurance is a crucial coverage that protects your business from the financial impact of unforeseen disruptions. For example, property damage insurance can cover your physical property in the event of a natural disaster, while the right business interruption insurance will handle the loss of revenue caused by interrupted business operations. If your business undergoes a significant interruption, this insurance can provide much-needed relief by supporting your temporary closure or relocation efforts.

Employment Practices Liability

Another kind of liability insurance businesses invest in is employment practices liability. This insurance offers valuable coverage for claims that arise against your business and employees, specifically addressing issues such as:

- Wrongful termination

- Discrimination

- Sexual harassment

- Other employment law violations

You can protect your business by not engaging in these practices in the first place, but if employees operate out of your purview, you could end up with a lawsuit on your hands. In these instances, you should try to right the wrongs, but you can also allow your employment practices liability insurance handle the costly litigation expenses.

There are many different types of business insurance you should know about so that you can get the coverage you need. If you already have comprehensive insurance but are unsure how to get your insurance company to cover you, let AmeriClaims help. We’re experienced commercial insurance adjusters who can properly assess your claim and negotiate with your insurance company on behalf of your business. We can get your insurance company to properly evaluate your claims, and you can leave the negotiating table with the compensation you’re entitled to.