How Do Insurance Companies Determine Claim Amounts?

Understanding the intricate process behind determining insurance claim amounts is crucial for policyholders. This knowledge empowers individuals to effectively prepare and negotiate for a fair settlement. However, it’s still hard to understand how insurance companies determine claim amounts. There are a lot of variables at play, and when you delve deeper into how they all work together, you can see how insurance companies come to their claim amount calculations.

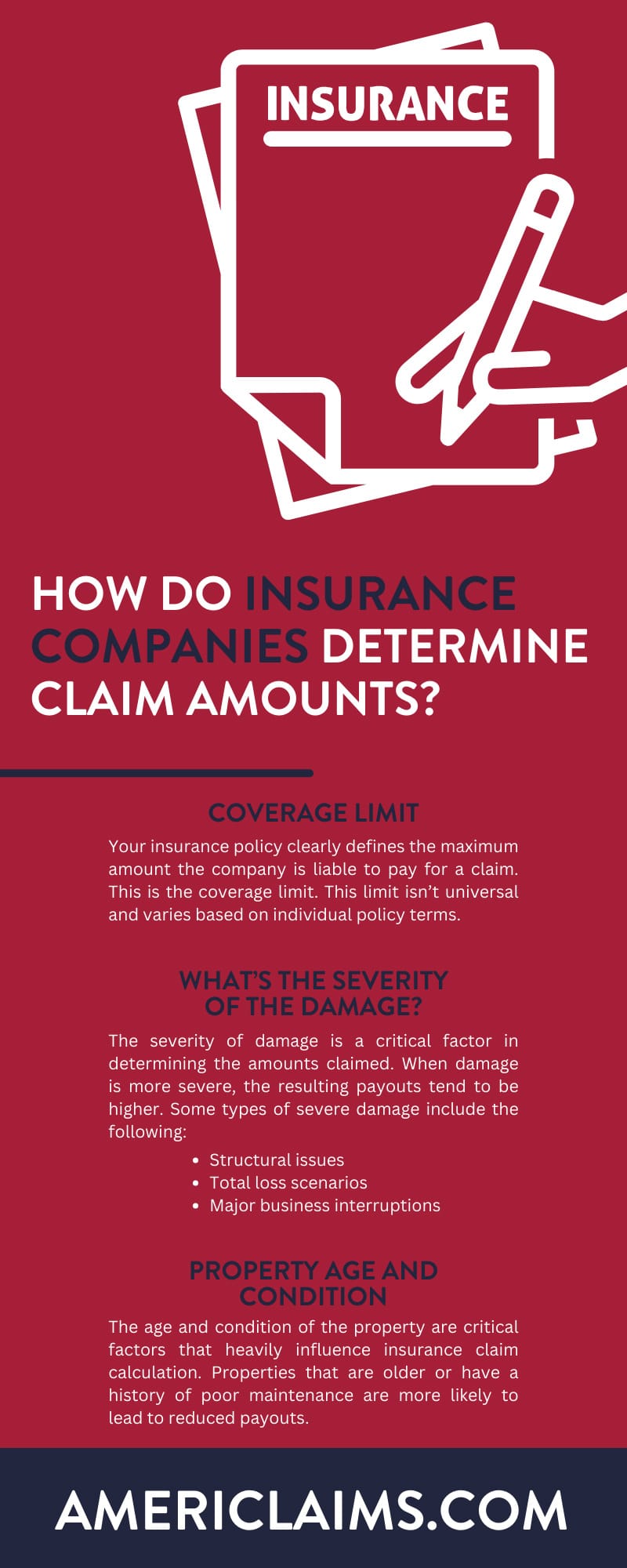

Coverage Limit

Your insurance policy clearly defines the maximum amount the company is liable to pay for a claim. This is the coverage limit. This limit isn’t universal and varies based on individual policy terms. Understanding your coverage limit is crucial as it determines the financial protection you have in case of unforeseen events. Review your policy carefully to ensure you have adequate coverage that aligns with your needs and potential risks.

What Are the Deductibles?

A policyholder has to pay a certain amount of money before their coverage begins. This is a deductible. It serves as a cost-sharing mechanism, with policyholders covering a predetermined sum or a percentage of the coverage limit before the insurance company starts paying for covered expenses. This financial threshold protects against minor claims and encourages the responsible use of insurance benefits.

Types of Damage

Another variable that insurance companies must consider is the type of damage they’re paying you out for. They make a clear distinction between different types of damage, such as cosmetic damage and structural damage that compromises the integrity of a building. These distinctions are pivotal in the thorough assessment of insurance claims, as insurance companies won’t pay out as much for minor damage.

What’s the Severity of the Damage?

The severity of damage is a critical factor in determining the amounts claimed. When damage is more severe, the resulting payouts tend to be higher. Some types of severe damage include the following:

- Structural issues

- Total loss scenarios

- Major business interruptions

Insurance adjusters inspect and evaluate the severity of damage to ensure an accurate calculation of the compensation required. By conducting thorough assessments, they can determine the extent of the damage and provide appropriate coverage for the policyholder.

Property Age and Condition

The age and condition of the property are critical factors that heavily influence insurance claim calculation. Properties that are older or have a history of poor maintenance are more likely to lead to reduced payouts. Some factors that insurance companies need to examine include the following:

- Age

- Wear and tear

- Structural integrity

- Overall state

This thorough evaluation ensures a fair and accurate assessment of the property’s value and any potential risks involved.

Any Policy Exclusions?

Insurance companies also pay close attention to policy exclusions. These exclusions play a significant role in determining coverage limits and the extent to which you can make claims. Understanding policy exclusions helps insurance companies identify limitations to ensure they don’t pay for anything in your claim that they don’t need to.

Valuation Methods

Insurance companies must also consider the different valuation methods. One of these methods is replacement cost, which calculates the cost to replace the item with a similar one. Actual cash value is another option, so they won’t pay the full cost of something that has depreciated over time. Another option is market value, where insurance companies consider the current market price of the property. Each method serves a specific purpose in accurately assessing the value of assets for insurance purposes.

What Are the Costs of Repairs?

The cost of repairs is a crucial factor in an insurer’s assessment of property damage claims. Insurers conduct a detailed analysis of repair expenses, carefully considering any depreciation that may apply to older items. This meticulous evaluation provides a precise and fair estimation of the overall claim value. Repairs can vary depending on the damage and the repair person, and all those numbers are essential for the insurance company to consider.

Proof of Loss

Proof of loss is a critical step in the claims process. Policyholders must provide thorough documentation or evidence that clearly outlines the extent of the damages incurred. This comprehensive documentation verifies the validity of the claim and contributes to streamlining the accuracy and efficiency of the entire claims processing procedures. An insurance company needs comprehensive proof of loss to adequately deal the policyholder a fair settlement amount.

Previous Claim History

Previous claims history can significantly influence how insurance companies evaluate and handle current claims. If an individual has a history of multiple claims, insurers may intensify their examination of new claims. They often delve into the frequency and types of past claims to make informed decisions regarding coverage and premium rates. This practice helps insurance companies assess risks accurately and tailor their services to an individual policyholder’s needs.

Legal Limits

Legal payout limits can constrain certain types of payments, such as compensatory and punitive damages. These limits tend to differ depending on the state in which the incident transpired and the specific insurance coverage carried by the parties concerned. It’s hard for a normal policyholder to understand these limits, but insurance companies account for them when calculating claim amounts.

Expert Opinions

Expert opinions play a pivotal role in insurance claims processing. Insurers frequently depend on expert evaluations, like detailed contractor estimates and specialized assessments, to guarantee precise determination of claim values. This meticulous approach enhances accuracy and thorough documentation for fair settlements, ultimately benefiting both insurers and policyholders.

Negotiation, Negotiation, Negotiation

Negotiation plays an essential role in insurance claims, as it empowers policyholders to secure a fair settlement. While insurance companies don’t know how much the needle will move during negotiations, they understand that there’s room for negotiation with claims amounts. That means they won’t initially give out a complete amount. Instead, they anticipate this possibility of negotiation in the future, so they’ll put forward a lower claim amount.

The Appeals Process

In situations where policyholders disagree with the calculated claim amount, they have the option to initiate an appeals process. During this phase, they can provide supplementary evidence, such as documentation or expert opinions, to bolster their case and present a more comprehensive argument for reconsideration. Insurance companies will then examine this appeal to determine if there’s merit or if the initial claim amount should stand.

Insurance companies rely on a myriad of factors and methodologies to determine claim amounts, but from the outside looking in, it’s hard to feel seen. Thankfully, you can get the professional North Carolina public adjusters at AmeriClaims on your side to make the process go quicker. Negations and appeals are a big part of insurance claims, and we’ll handle that and other communications to help you get back to normal life!