How To Calculate Business Interruption Loss for Insurance

Calculating business interruption loss for insurance can be a complex and daunting task. It requires a thorough understanding of your specific industry as well as the intricacies of your business operations and financials. However, with the right knowledge and approach, you can accurately calculate business interruption loss for insurance and ensure you receive proper compensation from your insurance provider. It will still take work, but it’s worth it when you can get the help from your insurance company that your business needs.

What Is Business Interruption Loss?

Business interruption loss refers to the financial impact of an unexpected event or disaster that disrupts your business operations. These interruptions can include natural disasters, such as hurricanes or earthquakes, or events like fires or power outages. In these situations, your business may experience a loss of income due to temporary closure or reduced production, as well as additional expenses for recovery efforts.

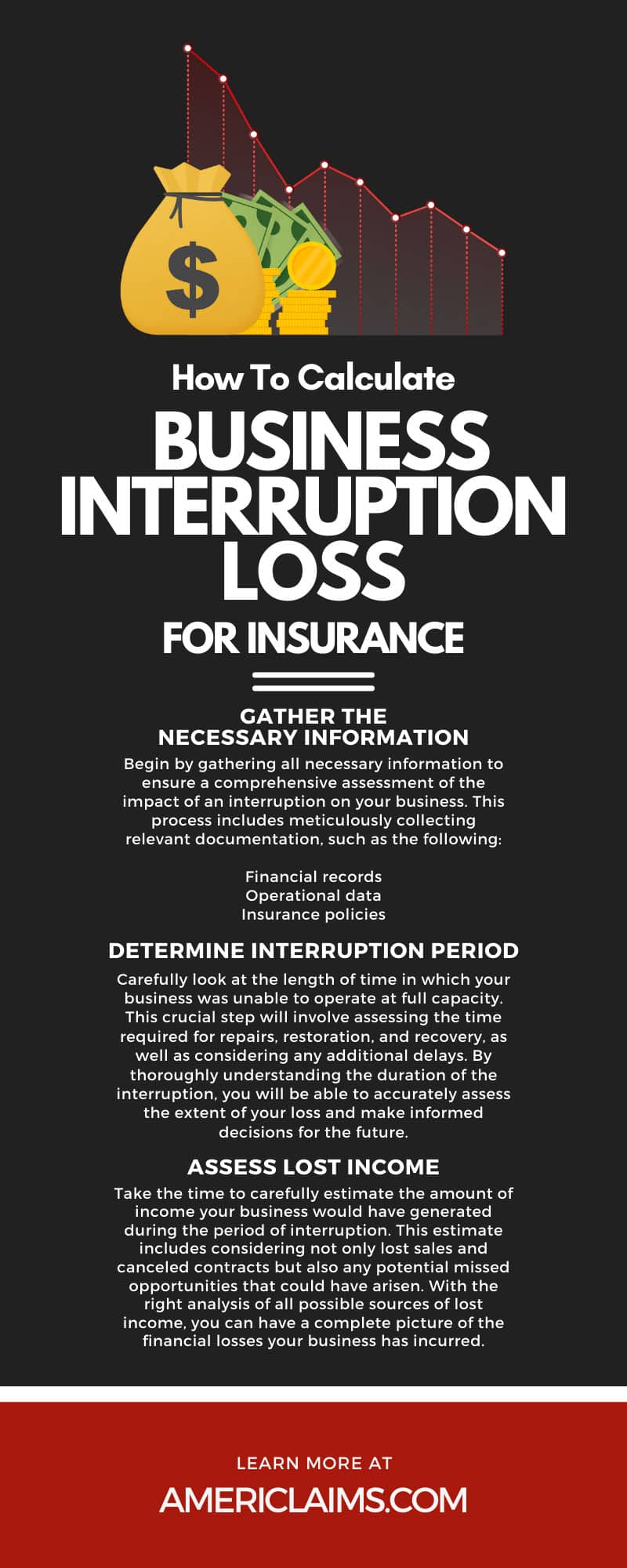

Gather the Necessary Information

Begin by gathering all necessary information to ensure a comprehensive assessment of the impact of an interruption on your business. This process includes meticulously collecting relevant documentation, such as the following:

- Financial records

- Operational data

- Insurance policies

By diligently examining these aspects, you will be able to accurately evaluate just how severe the interruption is for your business.

Determine Interruption Period

Another part of calculating interruption loss is determining the exact interruption period. Carefully look at the length of time in which your business was unable to operate at full capacity. This crucial step will involve assessing the time required for repairs, restoration, and recovery, as well as considering any additional delays. By thoroughly understanding the duration of the interruption, you will be able to accurately assess the extent of your loss and make informed decisions for the future.

Assess Lost Income

Take the time to carefully estimate the amount of income your business would have generated during the period of interruption. This estimate includes considering not only lost sales and canceled contracts but also any potential missed opportunities that could have arisen. With the right analysis of all possible sources of lost income, you can have a complete picture of the financial losses your business has incurred.

Calculate Variable Expenses

Variable expenses are costs that directly correspond with production or sales. These expenses include anything tied to the operational activities of your business, including:

- Materials

- Labor

- Equipment

When determining the amount these expenses would incur during the business interruption, consider the quantity and cost of materials and the number of hours required for production. When you carefully assess these factors, you’ll get a better understanding of the business interruption and losses your business is experiencing.

Determine Fixed Expenses

Fixed expenses are costs that remain constant regardless of business operations, such as rent, utilities, insurance, and subscriptions. These recurring expenditures play a crucial role in your financial planning, and you must carefully consider them when calculating your overall business costs. Taking the necessary time to identify and account for these fixed expenses ensures that you and your insurance company have a more comprehensive and accurate financial understanding of your business interruption.

Understand Additional Expenses

When assessing your financial situation, you need to take into account any additional expenses that may have arisen during the interruption period. Apart from the loss of income and variable costs, your business might have encountered unforeseen expenditures, like temporary relocation or rental fees for equipment. These unexpected costs can have a significant impact on your overall financial standing, and you must consider them when evaluating the full extent of the business interruption.

Calculate Gross Profit Loss

After taking all of this information in, you’ll have a better understanding of the losses incurred during the interruption, and you can then calculate the total gross profit loss. Through a careful analysis of all financial data and consideration of all relevant factors, you can accurately assess the interruption’s impact on your business’s overall profitability. This calculation provides valuable insights and helps you make informed decisions when it comes to filing a claim and optimizing your future operations.

Adjust for Savings

If your business was able to reduce certain expenses or increase income during the period of interruption, make adjustments accordingly to reflect the true impact on your bottom line. Consider evaluating the specific areas where you implemented cost-cutting measures or identifying the sources that contributed to the increased revenue. With these details, you can have a more comprehensive understanding of how the changes positively affected your financial situation during the interruption.

Factor in Potential Business Growth

If your business should have experienced growth during the period of interruption, you need to consider this growth when calculating the potential loss of income. By accounting for the anticipated expansion of your business, you can ensure a more comprehensive assessment of the interruption’s financial impact. This understanding will help you make a better claim with your insurance company that accurately reflects your losses.

Assess Coverage Limits

Take the time to thoroughly review your insurance policy to determine the maximum amount of coverage available for business interruption losses. You can better gauge the financial support available when you understand what your insurer can compensate you with. This knowledge enables you to make a more informed decision when it comes time to file a claim, and it also helps if you seek professional assistance from public adjusters.

Consider Exclusions and Deductibles

When reviewing insurance policies, you need to carefully consider the exclusions and deductibles. Exclusions refer to specific types of losses that may be limited or even excluded from coverage. Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage begins. Ideally, exclusions and deductibles wouldn’t play too big of a role when it comes to business interruption loss, but it’s still a big role that you must consider.

Calculate Final Loss Amount

After considering all the pertinent factors, such as the duration of the business interruption, the financial impact, and any additional expenses, you can calculate the final business interruption loss amount. With a comprehensive assessment and understanding of the losses your business has incurred, you can get your business back and running like normal in no time at all.

Calculating business interruption loss for insurance is a crucial step in ensuring that your business gets proper compensation. It’s still a difficult process, but when you follow these steps and get professional advice from the expert commercial insurance adjusters at AmeriClaims, it can go smoothly. By informing yourself and staying proactive, you can navigate the process with confidence and professionalism, and our adjusters can ensure your claim is proportional to your losses.